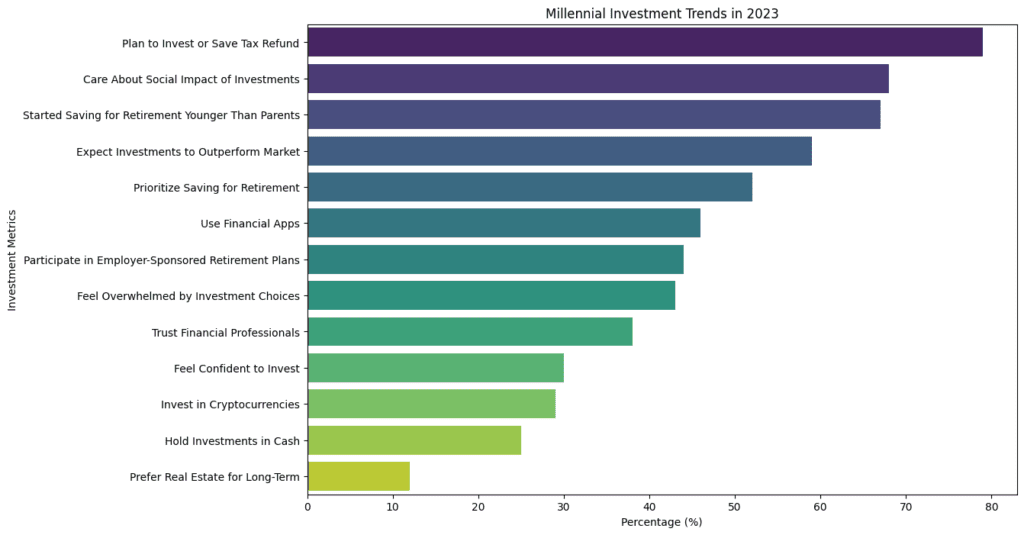

Millennial Investment Trends 2023: Expert Data Analysis

Our recent analysis on millennial investment trends showcases our expertise in data analysis, business intelligence, and AI/ML capabilities.

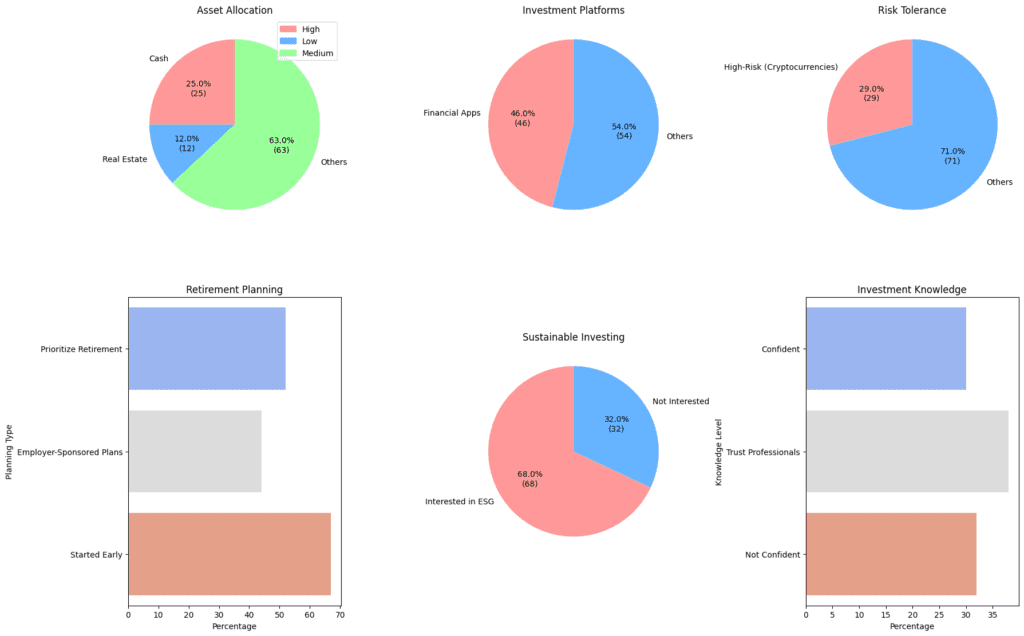

Asset Allocation:

Asset Allocation:

25% of millennials hold their investments in cash.

12% prefer real estate.

63% invest in other asset classes.

Investment Platforms:

46% of millennials use financial apps for investing.

54% use other platforms.

Risk Tolerance:

29% of millennials invest in high-risk assets like cryptocurrencies.

71% invest in other types of assets.

Retirement Planning:

52% prioritize retirement savings.

44% participate in employer-sponsored plans.

67% started saving for retirement earlier than their parents.

Sustainable Investing:

68% are interested in ESG and sustainable investing.

32% are not interested.

Investment Knowledge:

30% feel confident in their investment knowledge.

38% trust financial professionals.

32% are not confident.

Debt vs. Investment:

79% plan to invest or save their tax refund.

21% have other plans.

Market Timing:

43% feel overwhelmed by investment choices.

57% do not feel overwhelmed.

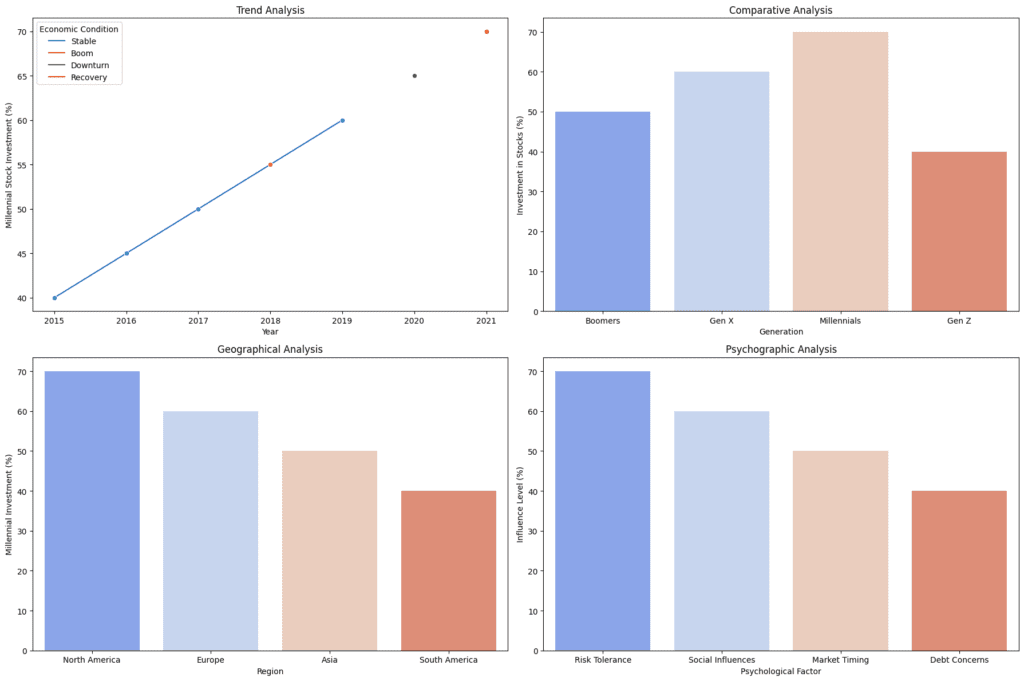

Trend Analysis: Millennial investment in stocks has seen a steady rise from 2015 to 2021. Economic downturns and booms play a significant role in shaping these trends.

Comparative Analysis: Millennials lead the way in stock investments compared to other generations. The future of investing is here!

Geographical Insights: North America is at the forefront of millennial investments, with Europe and Asia following closely.

Psychographic Analysis: Risk tolerance and social influences are major psychological factors driving millennial investment decisions.

📞 Let’s Collaborate! If you’re looking to harness the power of data for your business, reach out to us. From data warehousing and data lakes to advanced AI/ML solutions, we’ve got you covered.